Strategic Assessments for Distressed Companies

research report prepared by, Maria Vannucci, founder of Marican Incorporated.

* Appointed Business Rescue Practitioner with CIPC

* Advanced Certified Business Rescue Practitioner (UNISA)

Copyright to Marican Incorporated

This material is intended to be a guide only and no part of these materials are intended to be advice, whether legal or professional. You should not act solely on the basis of the information contained in these materials as parts may be generalized and may apply differently to different people and circumstances.

Further as laws change frequently, all practitioners, readers, viewers and users are advised to undertake their own research or to seek professional advice to keep abreast of any reforms and development in the law. To the extent applicable by law Marican Incorporated and all staff, exclude liability of any loss or damage claims and expenses including but not limited to legal costs, indirect special or consequential loss or damage (including but not limited to negligence) arising out of the information in the materials. Where any law prohibits the exclusion of such liability Marican Incorporated limits its liability to the re-supply of the information.

Introduction

Volatility in our economy has had a significant impact on the financial performance of virtually all middle market companies across most industries. Instability in the financing and credit markets, high unemployment, low consumer sentiment, and the subsequent impact on overall economic growth has forced many middle market companies file for business rescue proceedings or proceed directly into liquidation.

Companies in this position, specifically the business owners, are faced with an array of challenging decisions that will ultimately determine the future of the company, its employees, and all stakeholders. From the perspective of shareholders/management, choosing the right course of action during this critical time (i.e. recovery, restructuring, sale, bankruptcy, liquidation, etc.) is a daunting task.

As many distressed companies walk the fine line between viability and insolvency, the concept of Strategic Assessments has surfaced as a common approach to analyzing and understanding the best financial or strategic alternative. Strategic assessments use facts and data (both quantitative and qualitative) to develop and then build support for the plan.

As companies become more distressed, their future becomes more uncertain, which ultimately impacts various stakeholders, including shareholders, banks, management, employees, suppliers, customers, etc… Although virtually any company will find benefit in having a strategic assessment completed by an independent professional firm, it is particularly useful for distressed companies given that its various constituents will likely begin to raise serious questions about the company’s future.

Overview of a Strategic Assessment

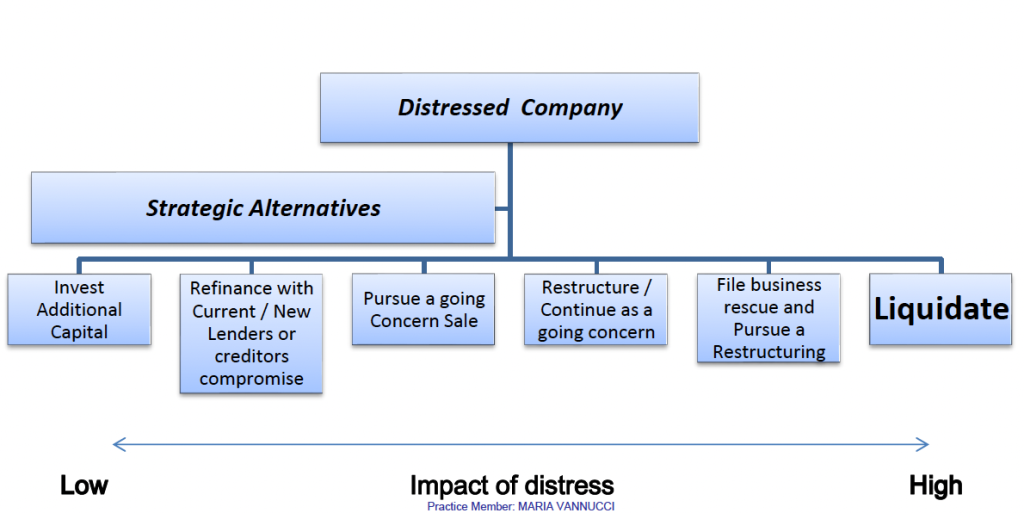

overall purpose of a strategic assessment is to provide an analysis of, and guidance on, the best strategic alternative available to a company given its specific situation. The cooperation from management and shareholders is typically needed. Generally speaking, a distressed company has a limited number of options it can pursue (as illustrated above page 3). The primary focus of the assessment itself is to determine which option will result in the best outcome for a company’s shareholders as well as the resulting impact of each of the options on various stakeholders.

Before a conclusion can be drawn, the advisor will perform an in-depth analysis to fully understand:

(1) the viability of the company as a going-concern, prospects of recovery and possible restructuring options,

(2) the market value of the company in a forced sale scenario and the likelihood a sale can be consummated,

(3) refinancing options, and

(4) liquidation value, as well any other relevant option.

The typical scope of work will vary depending on the amount of time available to complete the assessment and the amount of detail/depth of analysis required to reach a conclusion. The scope of work completed by the financial advisor in a strategic assessment will typically include the following:

➢ On-site visit and facility tour

➢ Interviewing key management and middle staff

➢ Gathering qualitative and quantitative information from company representatives, head of departments

➢ Analytical analysis of financial records

➢ Assessing Viability factors that caused distress

➢ Identify emergency objectives and implement an emergency cash flow plan

➢ Consider options and survival tools

➢ Utilizing projections created by management to analyze free cash flow (and developing upside and downside scenarios)

➢ Identifying improvement opportunities to enhance value

➢ Assessing the value of the company using various methodologies including:

- I. precedent transactions

- II. Public company comparable

- III. Discounted cash flow

- IV. Leveraged buyout

- V. underlying asset value

Components of a Strategic Assessment

The analysis performed during a strategic assessment is generally very detailed and meant to encompass all factors, both internal and external, that influence the company’s future performance. The crux of the advisor’s assessment will be an in-depth review of internal/company-specific factors from both a qualitative and quantitative perspective.

Additionally, external factors will be accounted for in terms of the overall economy, industry health, financial markets, etc. Once all components have been analyzed, conclusions and recommendations are derived as the various available strategic alternatives and what the outcome will likely be and how the various stakeholders are affected. Although strategic assessments will vary depending on a company’s specific situation, there are several key common areas of focus:

Components of a Strategic Assessment continued…

In terms of the quantitative analysis, facts are gathered relating to the company’s financial performance that will illustrate if the company is viable from a cash flow standpoint. Advisors will spend a considerable amount of time concentrating in this area as the conclusions drawn by the quantitative analysis will minimize any subjectivity.

On the qualitative front, one of the goals and certainly a central part of the assessment is to determine if the company has an identifiable “reason to exist.” In other words, are there unique attributes about the company that will give it a competitive advantage resulting in a situation whereby it will be able to generate a profit and be self-sustaining into the foreseeable future?

Ultimately, companies that cannot differentiate themselves from the competition and do not have an advantage whereby they can generate a profit will likely be a consolidation target (assuming that as part of another organization they can be profitable) or are deemed “not viable” and therefore not saleable as a going concern. The following text highlights and describes key areas of consideration for the company-specific factors measured in a strategic assessment.

Company Specific – Quantitative

Deep dive of historical and projected (pro forma) financial performance – Advisors serve as an unbiased third party and are responsible for challenging management’s projected financial performance. In many distressed scenarios, projections may be driven by a normalized run-rate to account for any recent restructuring initiatives and subsequent impact on key financial benchmarks such as gross margin and EBITDA. The ability to generate free cash flow in the near term will determine what options and how much time may be available to the company.

Cost structure/impact of restructuring efforts – Understanding the level of variable and fixed costs will be a focal point for advisors. Industries that are successful in passing raw material price increases on to customers are favorable. Advisors will also assess the ability to further cut costs and the materiality of past and future restructuring efforts to determine an accurate run-rate EBITDA.

Asset base assessment and/or appraisal – A fundamental component of assessing a company’s refinancing options understands its asset base and overall debt capacity (or lack thereof as in service business situations). Recent appraisals relating to the company’s owned land, buildings, and machinery and equipment are necessary to pinpoint an accurate borrowing base. If appraisals are outdated, discount rates are applied until new appraisals are completed.

Overall valuation of the company – Ultimately, all of the aforementioned quantitative factors of the strategic assessment will have an impact on valuation. Advisors will apply several valuation methodologies to establish a range of value for the company. Valuation will likely be the single-most influential component of the assessment as it relates to deciding which option will produce the best outcome for the company and its stakeholders.

Company Specific – Qualitative

Operational strengths and weaknesses – Value is significantly increased for companies considered a highly value-added provider of a product or service in a unique niche with specialized or technologically advanced processes. Highly technical and unique operations create a more risky and costly scenario for customers to simply change to an alternate vendor. In turn, these attributes help to enhance going concern value in the business beyond liquidation value given the competitive advantage and resulting profitability and increased cash flow. Capacity utilization will also be a key benchmark for assessing the operational stability of the company.

Product/service assessment – The attractiveness of products/services and end-user industries will impact the viability and salability of the company. Companies that manufacture or provide “niche” products/services and value-added content are differentiated from their competitors and are more likely to be viewed as having a “reason to exist.”

Competitive advantages – Proprietary technology processes, equipment, and patents are a few of the competitive advantages that can drive value. If it is difficult to identify and understand competitive advantages, the more likely it is that the company is struggling due to a flawed business model (as opposed to a good company with a bad balance sheet) and, thereby, may be unable to generate profits and be self-sustaining.

Assessment of key relationships with customers, vendors, and lenders – The financial health of customers and suppliers is a critical factor in the viability of any company. If customers or suppliers are believed to be distressed, value will deteriorate while the potential for a failed sale process increases. Advisors will complete a key customer deep-dive and assess customer concentration, profitability by product, and the ability of customers to resource work to an alternate vendor. A review of domestic and foreign customers will likely be performed to assess the impact of foreign accounts receivable on the company’s borrowing base.

Geographic presence – A dynamic facility footprint, proximity to key customers, and international production capabilities may be key differentiating characteristics. Although it is not crucial that a company maintain multiple locations in and of itself, it must, however, be able to compete and execute its plan with the geographic footprint that it maintains. Companies that have multiple locations are able to benefit from the advantages that result and may be more likely considered to be attractive and, thereby, potentially more saleable.

Potential buyer universe – Assessing the likelihood that a sale can be consummated is largely driven by the number of identified prospective buyers that: (i) are familiar with and/or compete in the industry, (ii) maintain experience with the seller’s products/processes, and (iii) can demonstrate an adequate source of financing. It is important to have an advisor that understands the industry and the various players because, although theoretically a company should be worth a certain value, it is another matter to know that there are buyers that would be willing and able to pay a certain value for the company. This is also the ultimate test of whether the company has unique attributes and a competitive advantage whereby the company is worth more being acquired as a going concern as opposed to a sale of the assets in a liquidation setting.

Strategic Alternatives – Although in reality every company’s situation is unique and the options available to them vary significantly, there are, however, some high level strategic options that typically exist in most situations. When considering these alternatives on a continuum, they include the injection of new capital on the “least disruptive to operations” end of the continuum with a complete liquidation of the assets of the company as being the most disruptive. The table below provides a high level overhead of the merger alternatives typically available.

Invest Additional Capital

In an effort to continue operations or as part of the long term plan, new capital may need to be injected in to the business.

The more distressed the company is the more likely it is that the existing shareholders will be diluted with the infusion of new capital.

In many situations this may be required to show commitment to the business and gain the support of other stakeholders.

It is typically considered to be a highly strategic move given the impact it typically has on the ownership structure and how it effects who controls/owns the company going forward.

Refinance with Current/New Lenders or creditors compromise

This option is typically only available if the company is only moderately underperforming or when the company has begun to show significant progress towards a full turnaround.

This option is highly dependent on current market conditions as it relates to lenders willingness to lend and the prevailing view/attractiveness of the company’s industries.

Additional capital may be required as a condition to receive additional debt financing or bringing in a new financial institution all together.

Pursue a Going Concern Sale

If it is determined that the business is saleable at a value likely to be in excess of a liquidation value a sale of the business as a going concern may be the best alternative.

Although it may not be considered the most attractive option by existing shareholders and/or management in many causes it may be the only other option than liquidations given the amount of harm that has been done to the company’s reputation in the market given its struggles.

Factors such as execution risk and incremental cash burn/funding required during the sale will play an important role in determining if a going concern sale results in the highest value and if it therefore will be the best strategic alternative.

Restructure/Continue as a Going Concern

This option may itself be a combination of investing additional capital and refinancing but essentially results in a new capital structure for the company whereby it positions the company to compete effectively in the future.

The enterprise value of the business is likely to be a major point of negotiation as it ultimately impacts the value and amount of the business. The question is, will the stakeholders be prepared to extend their risk and what are the repercussions if the rescue fails and the company proceeds into liquidation?

File Business rescue proceedings and pursue a Restructuring

The filing of business rescue is simply the vehicle by which the company is able to execute a strategy and not an end-game in and of itself.

Various strategies that may be accompanied as a result of a business rescue include: a reorganization of the company’s balance sheet, raise post commencement finance, the shedding of certain liabilities, compromise with creditors, etc.

Liquidate

In situations whereby the business is not saleable at an appropriate value as a going concern or if the various stakeholders are not able to reach a consensus on another plan in time a sale of the assets then a liquidation process may be necessary.

Liquidation is typically considered to be the last resort as it typically results in a significant loss for shareholders, lenders and a loss of jobs for management and employees.

Conclusion

Whether a well-performing company is looking for a fresh perspective on its strategic plan or the shareholders of a struggling company are trying to build consensus as they attempt to remake and improve their business, a strategic assessment is a valuable tool to assist in charting a company’s future.